There are a number of methods commonly used to evaluate fixed assets under a formal capital budgeting system. Project A depicts a constant cash flow; hence the payback period, in this case, is calculated as Initial Investment / Net Cash Inflow. Therefore, for project A to meet the initial investment, it would take approximately ten years. It is important because capital expenditure requires a huge amount of funds. So before making such expenditures in the capital, the companies need to assure themselves that the spending will bring profits to the business.

Throughput Analysis

Capital budgeting can also act as a tool to decline projects that induce negative social implications, thereby reasserting the company’s commitment to CSR. Refraining from investing in projects that cause environmental degradation or disregard labor laws is such an example. Capital budgeting plays a pivotal role in strategic financial management, providing key insights that are integral to the financial success of a firm.

Capital Budget Projects

Therefore, an expanded time horizon could be a potential problem while computing figures with capital budgeting. Although capital budgeting provides a lot of insight into xero accountants in auckland the future prospects of a business, it cannot be termed a flawless method after all. In this section, we learn about some of the limitations of capital budgeting.

- To have a visible impact on a company’s final performance, it may be necessary for a large company to focus its resources on assets that can generate large amounts of cash.

- Running operations with obsolete and less efficient assets has many significant competitive disadvantages, including increased costs, limited production and customers dissatisfaction etc.

- Capital budgeting is a useful tool that companies can use to decide whether to devote capital to a particular new project or investment.

- Therefore, they utilize capital budgeting strategies to assess which initiatives will provide the best returns across a given period.

- A capital budget can also assist with securing additional financing from banks or investors when pursuing a new investment project.

- It also reveals opportunity to invest more in successful projects and to cut losses on stranded ones.

Selecting a Project

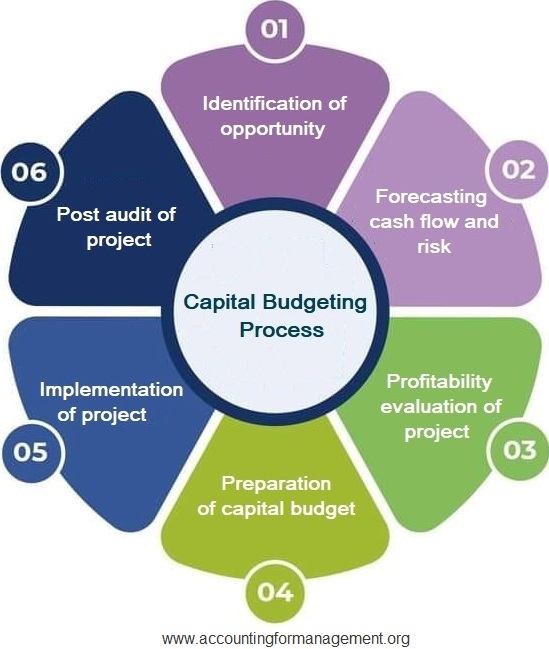

This step helps the management identify the flaws and eliminate them for future proposals. Once the project is implemented, now come the other critical elements such as completing it in the stipulated time frame or reduction of costs. Hereafter, the management takes charge of monitoring the impact of implementing the project. Assuming the values given in the table, we shall calculate the profitability index for a discount rate of 10%.

#1 Payback Period Method

With capital budgeting techniques, the company will know which is the best financial move and what can be reasonably expected. But, since capital projects tend to be longer term, there is always the potential for the unexpected to occur. There are other drawbacks to the payback method that include the possibility that cash investments might be needed at different stages of the project.

Despite being an easy and time-efficient method, the Payback Period cannot be called optimum as it does not consider the time value of money. The cash flows at the earlier stages are better than the ones coming in at later stages. The company may encounter two projections with the same payback period, where one depicts higher cash flows in the earlier stages/years.

It allows the firm to create a roadmap to guide its financial decisions and to ensure its capital is deployed in ways most beneficial for its long-term growth. After a project has been implemented, a post audit is conducted to check how close the actual results are to the estimated numbers. It helps minimize the chances of downplaying the costs or artificially inflating the profitability of a project, and thereby keep managers fair and honest in their investment proposals.

Capital budgets are geared more toward the long term and often span multiple years. Meanwhile, operational budgets are often set for one-year periods defined by revenue and expenses. Capital budgets often cover different types of activities such as redevelopments or investments, whereas operational budgets track the day-to-day activity of a business.